In late 2017, the European Union and the Bill & Melinda Gates Foundation pledged to invest more than $600 million over the next three years in developing new technologies, including quality seeds of improved varieties, for smallholder farmers in Africa and Asia. This sum is indicative of the priority being given to smallholder farmer productivity and its importance for achieving zero hunger, one of the 17 SDGs.

Delivering these technologies into the hands of smallholder farmers requires partnering with the private sector. Seed companies play a central role in providing access to quality seeds that can help smallholders to increase their yields and meet growing food demands while adapting their farming practices to increasingly challenging conditions brought about by climate change.

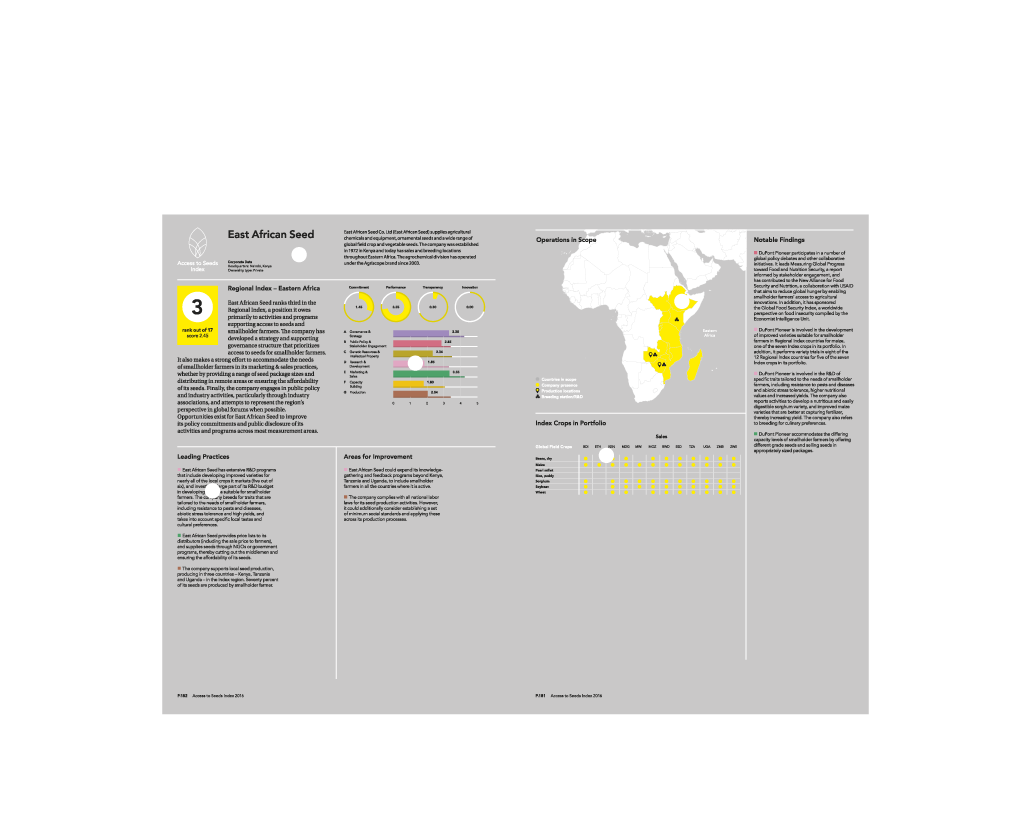

That is why the Access to Seeds Index assesses seed companies on their efforts to make quality seeds accessible to smallholder farmers and shines a light on leadership and good practice. By providing insights into companies’ performance, presence and portfolio, the index aims to contribute to building partnerships with the seed industry. It also establishes a benchmark for seed companies wanting to do more and informs policymakers working to create the necessary enabling environment.

The first Access to Seeds Index, published in 2016, assessed the activities of global seed companies in four regions and regional seed companies in Eastern Africa. Based on the findings of that index, which showed for the first time the crucial role regional seed companies play in delivering industry products to the farm gate, the second index will more than double the number of companies assessed – from 25 to 60 – as regional seed companies in Asia and Western Africa are now also part of the scope.

The index methodology is based on input from farmers, companies and policymakers, and was reviewed by dozens of experts from each region. Data collection will take place in 2018 and publication is scheduled for the first half of 2019.