Plant breeding lies at the heart of the seed industry. While many seed companies have breeding programs of their own, many regional companies, in particular in sub-Saharan Africa, depend heavily on the breeding and research programs of agricultural research institutes. Breeding is a continuous process that aims to respond to market demands and changing conditions. As such, breeding and research is subject to trends. These include the key traits companies focus on as well as type of crops and technologies used. Seed companies show little interest in breeding for nutritional value and legumes, both major areas for improvement. There are significant differences between company breeding programs. Global companies invest substantial resources in these programs, using modern technologies and track and trace systems, whereas small regional companies generally have limited facilities. Interestingly, small regional companies are increasingly setting up (modest) breeding programs, like Value Seeds in Nigeria. Others, such as Victoria Seeds, have decided to stop their breeding programs, depending largely on the research pipelines of agricultural research institutes.

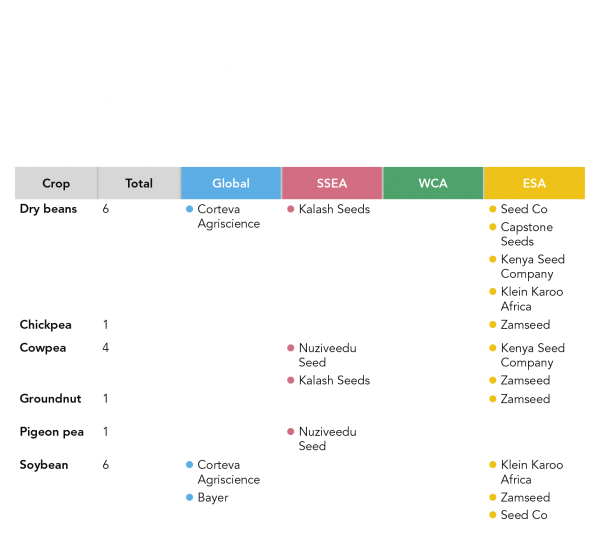

Seed companies predominantly sell high-yielding varieties with abiotic stress tolerance and disease and pest resistance. Shelf life is another important characteristic, followed by alignment with local preferences. Breeding for and selling varieties with abiotic stress tolerance has caught up with pest and disease resistance, compared to 2016. Companies explain that this is due to the increased effects of climate change. Nutritional value remains the characteristic that is least prominent in company breeding programs. Legumes, with their nutritional value, in particular proteins, were added to the crop scope of the 2019 index. However, breeding legume crops was found to be unpopular among seed companies and is largely left to agricultural research institutes. Only ten companies report selling legumes from their own breeding programs. Soybean and dry beans are bred by the most companies (six each), followed by four companies involved in breeding cowpea. Chickpea, groundnut and pigeon pea are only bred by Zamseed. Breeding for local crops has increased, notably among global seed companies. Twentyeight of the 62 index companies sell local crops. East-West Seed sells the most local crops (16 species), followed by Technisem (nine) and Limagrain (seven). While most of the local crop varieties sold by companies appear to be open-pollinated varieties, Rijk Zwaan stands out for its investment in developing hybrids of several locally important African crops. Breeding and selling varieties of local crops can also be seen as a contribution to nutrition security since these crops contribute to dietary diversity in a given region.